How much can you afford on a car? Find out how much you should spend on a car in your 20s and why—unless cars are your absolute passion—it’s probably way less than you think. Read more to get some advice.

In Trinidad and Tobago a car is a must! Public transportation is a total disaster and if you have any hope at being a productive member of society you really need one. But, cars in Trinidad are ridiculously expensive with the duties our government charges.

So how much should you spend on a car? How can you keep this required purchase from breaking your monthly budget and get a car that makes you happy?

The answer to this question, like so many questions, is it depends. It depends on your income, on your lifestyle, and on how important having a nice, cool car is to you.

How much should you spend on a car?

The simple answer is “As little as you can.” Money boils down to making good choices on the two biggest expenses in your adult life: the house you buy and the car you buy.

It doesn’t matter if you bring your lunch to work everyday or never buy a Rituals Mocha chiller (we love them), if you spend more than you can afford on a car. Those big bills will eat into any extra money you might have, making it harder to build up savings and grow wealthy through investing.

The most frugal people I know go out of their way to spend as little as possible on their car. It’s not just smart money; it’s a point of pride. They buy a used car, probably with cash. They drive their cars to 200,000 miles or beyond. They own one car for a family instead of two or three. And some really frugal ones don’t own a car at all.

So, really, how much should you spend on a car?

The ‘one-size-fits-all’ rule: 35% of income

A good starting point is 35% of your income. That means if you earn $60,000 TTD a year you should not spend more than $21,000 a year on a car.

However, this can really vary depending on how much someone makes which is why we think it makes more sense to break the rule into tiers. Only you can decide which tier is right for you based upon your financial situation, whether you’ll pay cash or finance with a bank, and how important your car is to you compared to other expenses.

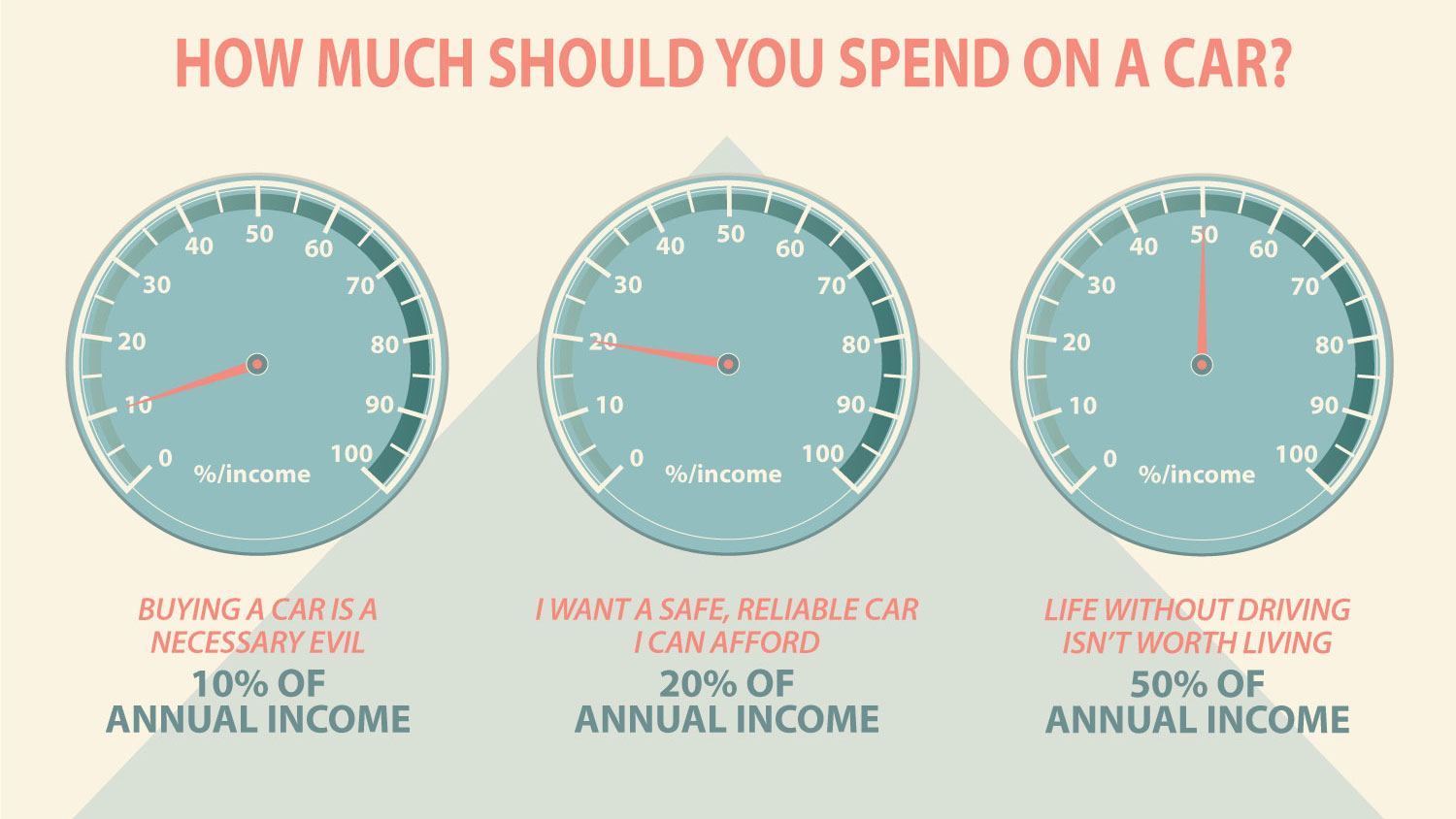

The frugal rule: 10% of income

We think most people fall into the bracket and should spend between 10–15 percent of your income on a car. So if you earn $60,000 TTD a year, that’s going to be an old high-mileage used car for $6,000 TTD (sounds dreadful doesn’t it?).

We love cars. I know this is tough reality, but if you want to save and attain your goals it’s a must.

Now what if you really, really love cars. Like anything in life there is a compromise!

The compromise: 20% of annual income

For us, if we are buying a new car it has to be safe and reliable. Especially with a young family and two busy working parents, reliability is key—sending the car to the shop all the time would be a hassle.

If you take pride in your frugality, 10–15 percent of your income sounds about right. If you value the reliability a newer, more expensive car brings, then 20–25 percent is a good benchmark. This gets you $20,000 to $25,00 on a $100,000 annual salary. Still not a lot, but you’ll have more options. At a salary of $200,000, following the “compromise rule” you can spend $40,000 to $50,000 which should be plenty for a basic used sedan under 100,000 km.

And, what if I really love cars?

If your a gas brain, the “frugal rule”, “the compromise” or “the one size fits all” may not sound too exciting. If this is your first time here (and assuming you’ve read this far), you might be thinking, “These people are so cheap! That’s crazy. There’s no way I can get a car I want for that money!”

We say, question yourself and ask yourself why do I need such an expensive car? Is it because you’re a “car guy (or girl)” and you value your car most out of all your possessions? Or is it because you’ve simply been conditioned by our Trinidad culture, flashy advertising, and talkative car salespeople to think that you should buy a brand new car and that there’s nothing wrong with spending a year’s worth of hard earned paychecks on a car?

Summary

Now, if you’re not a car person, the takeaway is to have our readers rethink why you should spend so much on a car.

Car dealers aren’t looking out for your well being. They will sell you anything once the bank will provide financing for it. They are thinking ‘what is the maximum amount of money can I get from this customer’. If you can’t pay the bank in the future or your job is unstable, you will definitely have your car repossessed (after paying the bank loads of interest).

We say, just stick to the simple rule: 35% of your annual income is really the max you should spend on a car. The average income in Trinidad is $10,000 TTD a month (or $120,000 a year). After tax that is roughly $100,000 a year. That means most of us should not spend more than $35,000 on a car. When we look around on the T&T roads, we see a lot of vehicles worth much more than that.

Don’t be financially strapped. Financially free yourself by making wiser choices.

Happy driving!